How fast will your home sell?

How fast is the real estate market moving? Assuming no other homes were to come on the market, how long would it take to sell all the houses currently for sale in midtown Tulsa? This is what we call the absorption rate. How fast homes are selling in midtown Tulsa depends on how fast the real estate market is moving and where your home is positioned in that market. Quite simply, the answer is different depending on the price point of your house.

Of course other factors will contribute to your home’s selling quickly: amenities, condition, floor plan, and of course, location.

How good are the chances of selling your home?

What are the odds of selling your house in midtown Tulsa? Do you have a good chance of selling your midtown home in the next 30 days?

How has the speed of the real estate market changed since last month?

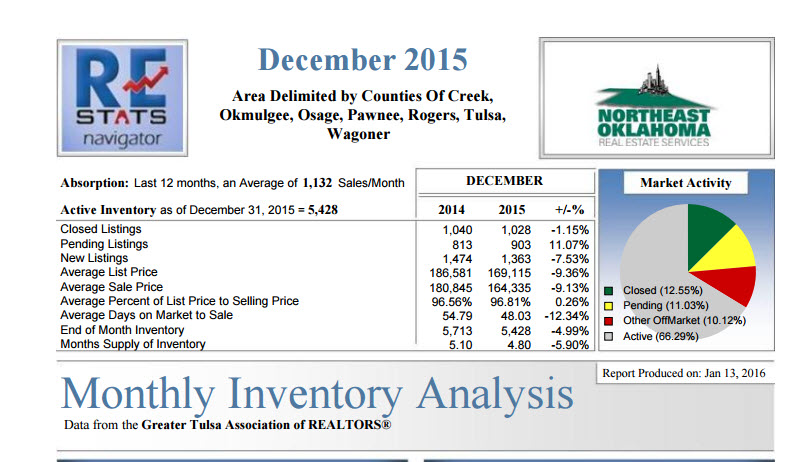

How has the absorption rate changed in the past 6 months? Is it going up or down? Up indicates the market slowing down. Down indicates the market is speeding up. Compare January 2016’s market statistics with the statistics from July, August, September, October, November, and December of 2015.

The Seller’s Market is Shifting to a Buyer’s Market

We are witnessing a shift from a seller’s market to a buyer’s market. The market shift seems to be occurring in midtown Tulsa at the price point between $350,000 and $450,000. Take a look at January’s statistics and decide for yourself whether or not it is a good time to buy a house or to sell a house.

Again, to see the shift occurring in slow motion, take a look at my blog posts over the past six months and notice the change in the absorption rate.

Remember, a six-month supply of homes indicates a buyer’s market and when there are less than 6 months of homes available, then it is considered a seller’s market.

Is it a good time to sell your home?

In my opinion, right now is an excellent time to either buy or sell a house in midtown Tulsa, because overall the market is fairly balanced.

Also, while noting that home prices fell slightly between December and January, historically our home prices usually increase in the springtime.

It’s your decision where to price your home. I provide data and you decide. For a look at how the market is in your particular Tulsa subdivision or midtown Tulsa neighborhood, please call me and I’ll work up the current statistics for you. It’s a constantly changing market and with all the fabulous amenities in our midtown Tulsa homes, each property value is different.

An appraiser can also help you decide how to position your home for the market.

Here are the market statistics for the three-month period from October 25, 2015 to January 25, 2016.

Compare these statistics with previous months’ statistics and see the trends for yourself.

Midtown Tulsa Real Estate Sales Statistics for Homes Sold by Price Point

(for the three-month period from October 25, 2015 to January 25, 2016)

Here are the latest market statistics for Midtown Tulsa.

Overall Average

Average Number of Bedrooms: 3

Average Number of Full Bathrooms: 2

Average Number of Half Bathrooms: 0

Average Number of Garage Spaces: 2

Median Year Built: 1947

Average Square Footage (heated space): 1,755

Average Acreage: 0.22

Average List Price: $215,006.00

Average List Price Per Square Foot: $122.51

Average Sales Price: $208,386.00

Average Sales Price Per Square Foot: $118.74

Average Sales Price to List Price Ratio: 97.16%

Average Cumulative Days on Market: 59

Months Supply of Homes: 3.69

Odds of Selling in 90 Days: 37.14 %

Up to $100,000

Average Number of Bedrooms: 3

Average Number of Full Bathrooms: 1

Average Number of Half Bathrooms: 0

Average Number of Garage Spaces: 1

Median Year Built: 1948

Average Square Footage (heated space): 1,209

Average Acreage: 0.19

Average List Price: $76,423.00

Average List Price Per Square Foot: $63.21

Average Sales Price: $73,831.00

Average Sales Price Per Square Foot: $61.07

Average Sales Price to List Price Ratio: 97.05%

Average Cumulative Days on Market: 72

Months Supply of Homes: 1.80

Odds of Selling in 90 Days: 41.38%

$100,000 to $150,000

Average Number of Bedrooms: 3

Average Number of Full Bathrooms: 1

Average Number of Half Bathrooms: 0

Average Number of Garage Spaces: 1

Median Year Built: 1951

Average Square Footage (heated space): 1,362

Average Acreage: 0.19

Average List Price: $127,700.00

Average List Price Per Square Foot: $93.76

Average Sales Price: $124,212.00

Average Sales Price Per Square Foot: $91.20

Average Sales Price to List Price Ratio: 97.39%

Average Cumulative Days on Market: 53

Months Supply of Homes: 3.36

Odds of Selling in 90 Days: 33.04%

$150,000 to $250,000

Average Number of Bedrooms: 3

Average Number of Full Bathrooms: 2

Average Number of Half Bathrooms: 0

Average Number of Garage Spaces: 2

Median Year Built: 1940

Average Square Footage (heated space): 1,727

Average Acreage: 0.21

Average List Price: $201,597.00

Average List Price Per Square Foot: $116.73

Average Sales Price: $193,422.00

Average Sales Price Per Square Foot: $112.00

Average Sales Price to List Price Ratio: 96.59%

Average Cumulative Days on Market: 41

Months Supply of Homes: 2.34

Odds of Selling in 90 Days: 41.84%

$250,000 to $350,000

Average Number of Bedrooms: 3

Average Number of Full Bathrooms: 2

Average Number of Half Bathrooms: 0

Average Number of Garage Spaces: 2

Median Year Built: 1940

Average Square Footage (heated space): 2,164

Average Acreage: 0.24

Average List Price: $299,594.00

Average List Price Per Square Foot: $138.44

Average Sales Price: $287,975.00

Average Sales Price Per Square Foot: $133.08

Average Sales Price to List Price Ratio: 97.30%

Average Cumulative Days on Market: 61

Months Supply of Homes: 2.72

Odds of Selling in 90 Days: 41.56%

$350,000 to $450,000

Average Number of Bedrooms: 3

Average Number of Full Bathrooms: 2

Average Number of Half Bathrooms: 1

Average Number of Garage Spaces: 2

Median Year Built: 1948

Average Square Footage (heated space): 2,689

Average Acreage: 0.34

Average List Price: $408,589.00

Average List Price Per Square Foot: $151.95

Average Sales Price: $395,593.00

Average Sales Price Per Square Foot: $147.12

Average Sales Price to List Price Ratio: 96.83%

Average Cumulative Days on Market: 122

Months Supply of Homes: 10.00

Odds of Selling in 90 Days: 13.85%

$450,000 to $600,000

Average Number of Bedrooms: 4

Average Number of Full Bathrooms: 3

Average Number of Half Bathrooms: 1

Average Number of Garage Spaces: 2

Median Year Built: 1972

Average Square Footage (heated space): 3,328

Average Acreage: .37

Average List Price: $550,000.00

Average List Price Per Square Foot: $165.26

Average Sales Price: $524,500.00

Average Sales Price Per Square Foot: $157.60

Average Sales Price to List Price Ratio: 95.46%

Average Cumulative Days on Market: 69

Months Supply of Homes: 6.75

Odds of Selling in 90 Days: 14.29%

$600,000 to $800,000

Average Number of Bedrooms: 4

Average Number of Full Bathrooms: 3

Average Number of Half Bathrooms: 1

Average Number of Garage Spaces: 2

Median Year Built: 1947

Average Square Footage (heated space): 3,991

Average Acreage: 0.34

Average List Price: $719,500.00

Average List Price Per Square Foot: $180.28

Average Sales Price: $688,700.00

Average Sales Price Per Square Foot: $172.56

Average Sales Price to List Price Ratio: 95.75%

Average Cumulative Days on Market: 33

Months Supply of Homes: 15.00

Odds of Selling in 90 Days: 10.20%

$800,000 to $1,200,000

Average Number of Bedrooms: 4

Average Number of Full Bathrooms: 3

Average Number of Half Bathrooms: 2

Average Number of Garage Spaces: 3

Median Year Built: 1991

Average Square Footage (heated space): 5,597

Average Acreage: 0.47

Average List Price: $1,226,667.00

Average List Price Per Square Foot: $219.17

Average Sales Price: $1,073,000.00

Average Sales Price Per Square Foot: $191.71

Average Sales Price to List Price Ratio: 87.97%

Average Cumulative Days on Market: 112

Months Supply of Homes: 24.00

Odds of Selling in 90 Days: 6.82%

Above $1,200,000

Average Number of Bedrooms: 4

Average Number of Full Bathrooms: 4

Average Number of Half Bathrooms: 2

Average Number of Garage Spaces: 3

Median Year Built: 1958

Average Square Footage (heated space): 5,980

Average Acreage: 0.92

Average List Price: $1,825,000.00

Average List Price Per Square Foot: $305.18

Average Sales Price: $2,010,200.00

Average Sales Price Per Square Foot: $336.15

Average Sales Price to List Price Ratio: 109.23%

Average Cumulative Days on Market: 53

Months Supply of Homes: 18.00

Odds of Selling in 90 Days: 9.09%

Statistics compiled by Debbie Solano, ALC, CRS, from data provided by NORES and the Greater Tulsa Association of REALTORS® for the period from October 25, 2015 through January 25, 2016.

Area covered includes single-family houses located between I-244 and I-44 from River Parks to Sheridan.

Information is deemed reliable, but not guaranteed. Does not reflect all market activity.

Get Shortlink: http://midtowntulsarealestate.net/?p=906

________________________________________________________________________

Debbie Solano is an Accredited Land Consultant and Certified Residential Specialist with a Broker-Associate license which hangs at the Midtown Tulsa office of Coldwell Banker Select REALTORS®. She would enjoy your feedback or questions. She can be reached at 918-724-8201 or dsolano@cbTulsa.com.

Copyright © 2016 by Deborah M. Solano — ALL RIGHTS RESERVED — Midtown Tulsa Real Estate — Midtown Tulsa Real Estate Market Statistics: January 2016